Ag Informer – Gas Prices Hit Another Record

Gas prices crushed another record to start June, and experts say there’s no sign of a slowdown yet with $5 gas a strong possibility as the summer driving season pushes into high gear.

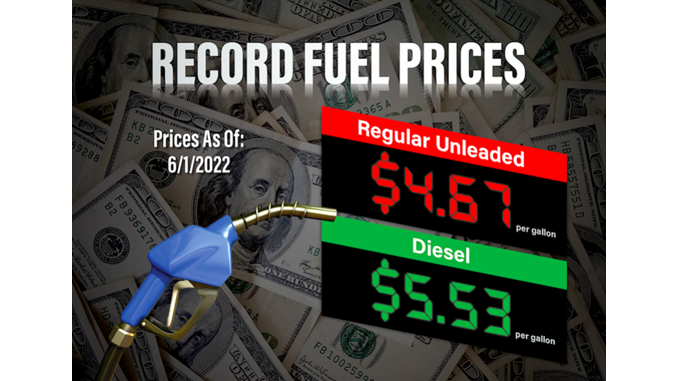

The new highest all-time record is now $4.67 a gallon. AAA reports seven states now average $5 a gallon or higher, which includes California and Illinois.

GasBuddy, which tracks real-time fuel prices at more than 140,000 gas stations in the U.S., Canada and Australia, has been following the recent run-up closely. Patrick De Haan, head of petroleum analysis for GasBuddy, spoke with AgWeb about why prices continue to climb after the Memorial Day weekend.

“It’s almost like every five minutes, I see the little live indicator tick up on our GasBuddy data. We are now at $4.70 and four-tenths. 15 minutes ago, we were at $4.70,” says De Haan. “We continue to actively climb here throughout the day. This is a culmination of a big jump in the wholesale price of gasoline that happened last week.”

De Haan says prices have jumped 52 cents in just a month. Prices are up $1.65 compared to a year ago. He says there are no signs of a slowdown anytime soon.

“I think gasoline could be headed the way of diesel potentially, at least nationally, the price of gasoline could eventually hit that $5 gallon mark,” says De Haan.

The soaring prices are led in part by strong demand as people ramp-up travel plans and a sluggish supply. The jump also comes after the European Union reached a deal to ban 90-percent of its Russian oil imports by the end of the year.

According to Farm Journal Washington Correspondent Jim Wiesemeyer, President Biden sees no quick fix on gas prices. Biden told reporters at the White House on Wednesday the U.S. has no immediate way to slash the price Americans are paying for gasoline and is considering other proposals such as trying to set a lower price for sale of Russian crude.

Wiesemeyer also reports Biden is likely to visit Saudi Arabia later this month as part of an international trip for NATO and Group of Seven meetings. He says Saudi Arabia and other OPEC members may boost oil output to offset a drop in Russian production, a move that could take some pressure off surging global inflation and pave the way for an ice-breaking visit to Riyadh by Biden.

Kansas State University agricultural economist Glynn Tonsor says while there’s not one strong indicator a recession is imminent, domestic meat demand hinges on whether the U.S. economy runs out of gas.

“Beef demand, in particular, historically, is tied to consumer incomes. If we have a recession, we would anticipate weaker beef demand and maybe protein demand overall, but particularly beef demand,” says Tonsor.

Tonsor says typically a recession isn’t defined until after the fact, but watching consumer confidence, as well as shopping habits, are both solid indicators of what’s to come.

“We’re on the road in the summer more, so we may not be done with those higher gas prices is the point,” adds Tonsor. “Yes, it does eat pocketbooks. All else equal, if one input and your budget goes up, that eats into your discretionary income for other categories. And we are watching that.”