Ag Informer – Land Prices Continue to Soar

The stronger land prices of late 2021 continued higher through the first half of 2022, reports Randy Dickhut, senior vice president for Farmers National Company (FNC), Omaha. Nebraska.

After a calm period in January in which the land market remained steady, sales prices took another jump as a result of the outbreak of war in Ukraine and ongoing inflation fears, he notes. Farmers saw stronger commodity prices and investors wanted a low-risk inflation hedging investment, which together propelled the competition for good cropland.

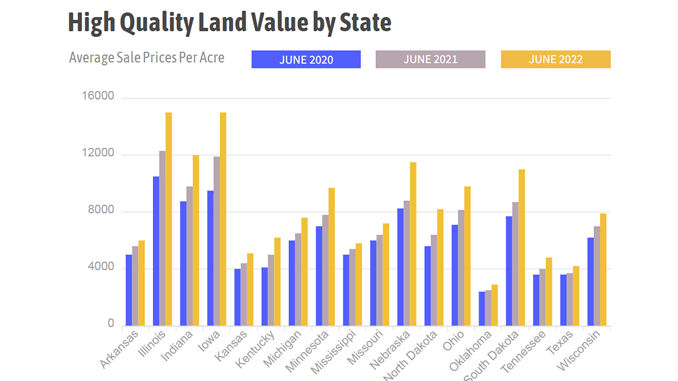

“Prices for good quality cropland are up 20% in some areas since the first of the year,” Dickhut says. “Recent FNC auction sales demonstrate the strength in the land market so far in 2022. Good land that was selling for around $16,000 last fall sold for $19,000 to $21,500 per acre at company auctions in March. This increase in prices is on top of a 15% to 30% jump in value across most Grain Belt states in 2021.”

Here are regional reports from FNC:

Western Corn Belt

During the past few months, we have seen prices paid for quality cropland go above $20,000 per acre in Iowa, $15,000 per acre in South Dakota and one farm in North Dakota brought $12,000 per acre. A lot of land sells for less than these prices, but the high ones are catching everyone’s attention,” says area sales manager Brian Mohr.

Increased amounts of land came on the market at the end of 2021 due to concerns about possible tax law changes along with the lure of higher sales prices. Demand from farmers and investors more than offset the additional farms on the market to drive land prices up significantly. Sales slowed down in early 2022, but demand remained strong.

Iowa led the market activity in late 2021 with more sales and higher prices.

“The amount of land sold by FNC in Iowa last year was up 152% over the previous year, with auction sales up 129% year over year. Our company auctioned five times more land in the last part of 2021 than in the last quarter of 2020,” notes assistant sales manager Tom Schutter.

“This summer, we expect strong prices to continue. This is contingent on world events, grain production and how rising interest rates and higher input costs will impact buyer demand for farmland,” Mohr adds.

Eastern Corn Belt

“During the past few months, we have seen prices paid for quality cropland go above $21,000 per acre in Illinois, $17,000 per acre in Indiana and $16,000 in Ohio. Says area sales manager Linda Brier. Auctions led the market activity in late 2021 and early 2022 with more sales and higher prices.

“The amount of land sold by FNC by auction during the fall and spring sales season was up 106% over last year,” Brier notes.

Similar reports of strong sales in the Plains and Missouri come from area sales manager Paul Schadegg. He notes prices paid for quality cropland go above $13,500 per acre in Nebraska, $14,500 per acre in Missouri and $7,000 in central Kansas.

Will Land Prices Go Even Higher?

With a return to a normal supply of cropland for sale, farmers who are looking forward to several years of higher grain prices have continued to aggressively bid for the land that did come up for sale during the past few months, he states. Individual investors also stepped into the market as they looked at farmland as a safe, long-term inflation hedging investment. This combined heightened demand propelled land prices higher in 2022.

The question of the moment, he says, is, will land prices go even higher?

“Farmers, landowners and the agricultural industry are facing more uncertainty at this moment than almost any other time. The Ukrainian invasion has thrown in a multitude of short and long-term unknowns in the food and ag world,” Dickhut says.

Inputs like fuel and fertilizer are vastly more expensive, raising the cost to produce a crop while feed costs are much higher for livestock producers. Grain prices are at historic levels, but will these go higher or lower? Will farmer buyers become more cautious in their outlook to bid up land if input costs and supply chain issues escalate?

Inflation and stability concerns have come to the forefront when making investment decisions. These concerns increase the demand for land right now as it is generally accepted that farmland is a safe, secure, long-term investment during periods of inflation. Rising interest rates will increase the cost of land mortgages, which will have some damping effect on land prices. How far and how soon rates go up will determine the extent of the interest rate influence, he observes.

“The importance of secure and adequate food, fiber and fuel supplies has taken center stage throughout the world. United States agriculture, as the world’s most productive and secure grain and livestock supplier, comes to the forefront of world trade now and will continue in the future. Farmers realize the potential and are therefore willing to bid up land prices in order to control more acres for the years to come. Individual and fund investors are realizing this too and are stepping more into the farmland market,” Dickhut states.

Anything can change at a moment’s notice with the weather, commodity markets, world events and government actions. All will affect agriculture and therefore, the price of farmland, Dickhut notes. The supply of land for sale and how demand holds up over the next months also will be determining factors on land prices.

“With current land prices at heightened levels, most of the supporting factors remain in place currently to keep values steady to firmer for the next six months. This outlook could be altered at any moment due to unexpected changes in a multitude of factors,” Dickhut adds.